From its wooded bluffs to the waters of the mighty Mississippi, the area offers endless opportunities to enjoy nature at its best during any season.

From its wooded bluffs to the waters of the mighty Mississippi, the area offers endless opportunities to enjoy nature at its best during any season.

Welcome to Prairie du Chien, WI

Welcome to Prairie du Chien, WI

Welcome to the City of Prairie du Chein’s official government website: your source for information on city services, departments, programs and much more.

The Villa Louis

The Villa Louis

The Villa Louis is a National Historic Landmark located on St. Feriole Island, in Prairie du Chien, southwestern Wisconsin.

Prairie du Chien and St. Feriole Island

Mississippi River Sculpture Park

Mississippi River Sculpture Park

The sculptures are one-of-a-kind works of art made in the tradition of famous museum pieces and other public bronze monuments.

St. Feriole Islands Memorial Gardens

St. Feriole Islands Memorial Gardens

The St. Feriole Islands Memorial Gardens consist of 10 acres of pocket gardens and full fields of gardens.

The Prairie du Chien Area Chamber of Commerce mission is to serve & expand our business community by working together with our members in our region, providing opportunities, information services, advocacy, and tourism.

Lawler Park

Lawler Park

This favorite park was named for John Lawler, the builder of the famed pontoon railroad bridge. Visitors can enjoy the Walk of History, a series of 10 marble etchings telling highlights of Prairie du Chien’s past.

Villa Louis Carriage Classic

Villa Louis Carriage Classic

Held Annually the weekend after Labor Day, the Villa Louis Carriage Classic highlights competitive carriage driving in arena and obstacle classes.

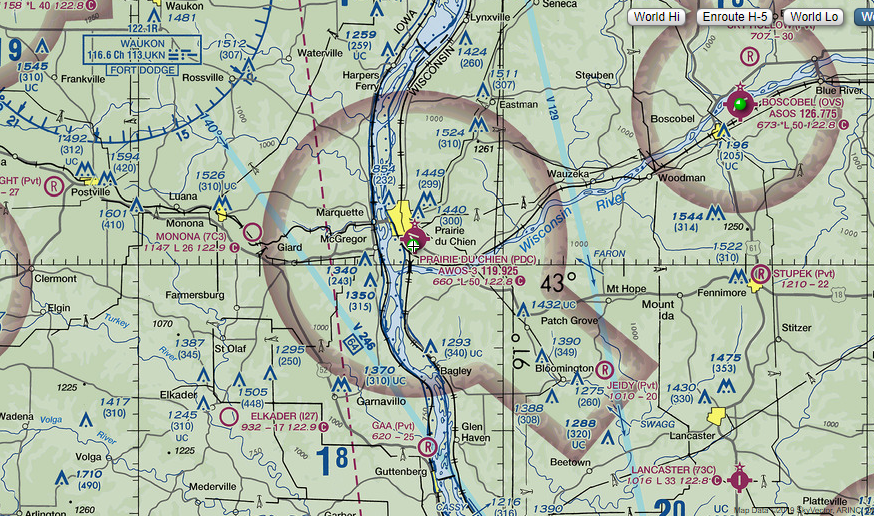

Prairie du Chien Municipal Airport is a city-owned public-use airport located two nautical miles southeast of the central business district of Prairie du Chien, WI. (KPDC)

Calendar

| Sun | Mon | Tue | Wed | Thu | Fri | Sat |

|---|---|---|---|---|---|---|

| Design and Preservation Commission 5:00 pm Design and Preservation Commission Apr 8 @ 5:00 pm – 7:00 pm 2024-4-08 Design Preservation Commission Agenda | ||||||

| Finance 6:30 pm Common Council Re-Organization Meeting 6:45 pm Common Council Re-Organization Meeting Apr 16 @ 6:45 pm – 7:00 pm 2024-04-16 COMMON COUNCIL AGENDA(Reorginization Meeting) Common Council Meeting 7:00 pm | ||||||